The Healthcare Realty Opportunity

SHR is looking to capitalize on current market conditions and a variety of long-term factors, including historical high yield performance compared to other real estate asset classes, stifled compensation, advantageous demographics, positive impact of emerging trends in a still highly fragmented industry.

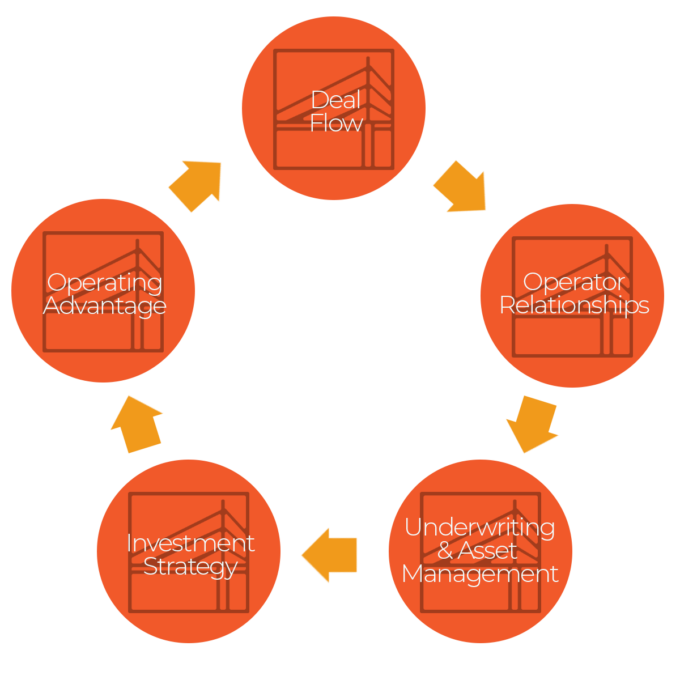

Execution is Key

Since its inception in 2002, SCP& CO has completed eighty transactions totaling $1.8+ billion of aggregate transaction volume. Over half of the firm’s transactions have been platform acquisitions, financings, or add-on’s for SCP& CO’s Principals’ buyout control investment vehicles.